How SMART FNOL takes the pain from low impact high volume motor claims

Mike Brockman, CEO, ThingCo, describes how a Smart FNOL process can accelerate and improve claims through next generation telematics London, 22 December 2021 – Developing a SMART process for first notification of loss (FNOL) is perhaps the most valuable aspect of telematics-based motor insurance. When done correctly, it can improve loss ratios by up to five […]

Mike Brockman, CEO, ThingCo, describes how a Smart FNOL process can accelerate and improve claims through next generation telematics

London, 22 December 2021 – Developing a SMART process for first notification of loss (FNOL) is perhaps the most valuable aspect of telematics-based motor insurance. When done correctly, it can improve loss ratios by up to five points, all on its own. The telematics journey can really help understand the circumstances of accidents and critically determine liability, but it all hinges on the quality of the data.

Smart FNOL vs Standard FNOL

Typically, in traditional motor insurance, insurers must wait for their customers, or a third party, to notify them that an accident has happened. A process is then triggered where the FNOL agent begins a dialogue with the customer, working through a script to determine the details of the incident. This can often take up to 30 minutes. Given that the customer has likely to have just had a pretty traumatic experience, they can often feel disorientated and struggle to recall all the details.

There are also cases when insurers only become aware of an accident after the claim is lodged by a third party, typically fault claims and through the MOJ portal if with personal injury.

These different routes to a claim can often be slow and complicated, supported by incomplete and inaccurate evidence when the process should ideally be rapid, and evidence based.

With telematics and a SMART FNOL process, a crash algorithm is triggered if the vehicle is thought to have been in an accident, which sends an alert to the FNOL agent. That alert could also be voice activated within the car as well as going directly to the FNOL agent, who would receive the location of the incident, the G-forces generated, a liability assessment, and details on the build-up to the accident. The agent can then call the customer when safe or speak direct in-car. The agent will then ask the customer for details and will compare this with the telematics view. If the two stories match, happy days, and the claim can be dealt with quickly, efficiently and effectively, If not, more questions need to be asked and in extreme cases sent to the fraud team.

The real difference insurers find when they have telematics on-board is the ability to be considerably more proactive; getting to the customer and third parties immediately where possible.

Most telematics devices concentrate on the bigger claims with G-forces of greater than 2, which for a typical young driver book can account for up to 65% of total claims cost. The false positive rate for alerts with these claims can also be reduced since it is easier to identify from the g-force profiles, the real events. The bigger the G-forces, the fewer events there are that look like accidents- a car boot or door being shut with vigour or a wheel hitting a pothole at speed.

By using the data in a clever way, however, the traditional FNOL process for the smaller claims can also be made massively more efficient both in process time and in assessment of liability.

Understand and using G-forces

Most telematics devices provide G-forces in three dimensions, these are the X, Y, and Z axes. The X-axis is the G-force that goes through from the front to the back of the car. This determines if the car is accelerating or braking. The Y-axis moves across the car from the driver’s side to the passenger’s side, representing turning, and the Z-axis measures vertical G-force from the top of the car to the bottom, which shows a hit from a pothole or bounce.

If a driver is accelerating harshly, the G-forces registered will tend to be less than -0.4, G-forces higher than 0.6 will be recorded with harsh braking, and harsh cornering will record G-forces greater than 0.5 and lower than -0.5.

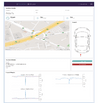

For example, we recorded the accident below that had G-forces of more than 2 in total after combining all the measurements. It had a G-force of -1.8 on the X-axis and had a -0.4 G-force on the Y-axis. There was a G-force of 1.2 on the Z-axis. This combination of measurements represents the threshold of which telematics devices typically will start to trigger an alert.

The negative recording on the X-axis shows this was a rear impact accident, which means the car in the back hit and pushed the vehicle forwards. The negative y shows the car moved slightly left implying a rear left side impact. The sizeable Z-axis recording indicates the car at the back caught and lifted the other vehicle on impact.

From the location map, it can be seen that this is a classic roundabout accident, which can be immediately processed as a no fault claim.

By recording the maximum and minimum g-forces during every 1 second interval, a similar picture can be drawn at the point of FNOL notification for all claims where there is trip data.

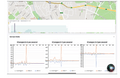

The diagram below shows a low impact claim, where location, time of accident and liability can easily be established. Furthermore, accidents with g-forces less than 2 are unlikely to result in personal injury which is another important piece of information.

The above pattern of g-forces indicates a front, passenger side damage with fault liability.

The granularity of the data means standard notification processes can be validated in the same way as pro-active alerts. FNOL agents can go back through the data recorded on the customer’s device and compare it with the events relayed to them, validating, or raising inconsistencies in the story.

There is so much more that telematics can do to improving traditional FNOL processes; It’s all about being SMART with the data – making it work as hard as possible in each and every claim scenario. A Smart FNOL process will ultimately provide the ability to give honest customers the best accident service possible whether at fault or not, with the shortest possible key-to-key times which after all, is what all insurers should be striving for.