News & Insights

12/17/2025

Early intervention strategies could help reduce driver risk over the Christmas period

Data analysis from telematics insurtech, ThingCo, has revealed a clear opportunity for insurance providers to take proactive measures to help their motor insurance customers stay safe on the roads this holiday period. Claims frequency significantly increases in winter as roads become more unpredictable, and driving overnight doubles over the Christmas period, increasing risk still further.

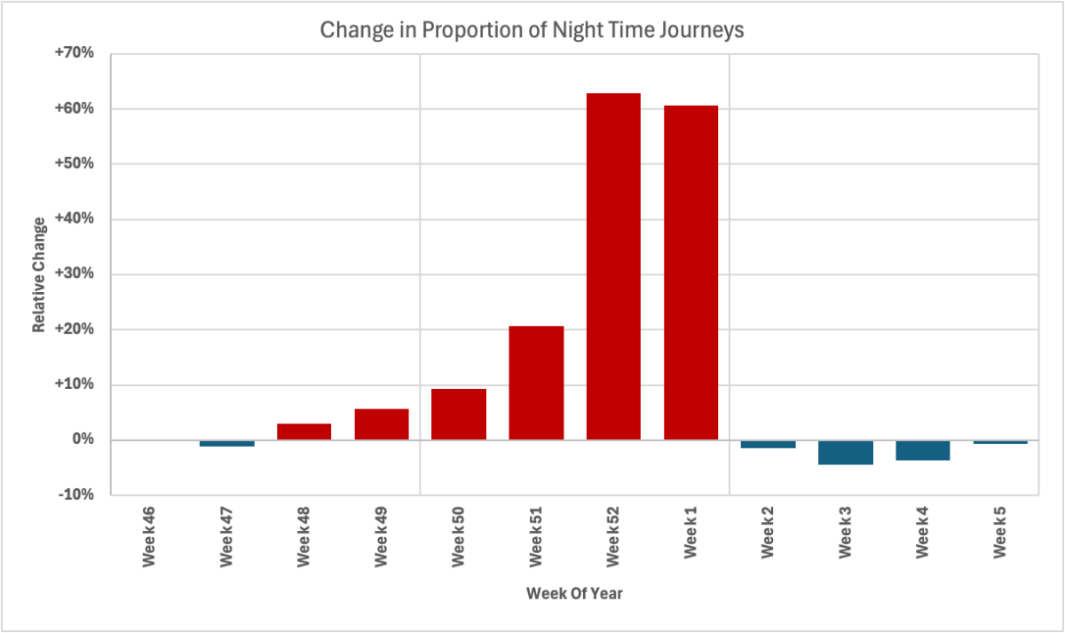

Motor insurance claims peak in the first week of November as drivers get used to the darker evenings, while icy conditions see further increases despite a reduction in average mileage. ThingCo telematics data also showed a 60% increase in the proportion of trips driven between the hours of midnight and 5am in the last two weeks of December and first week of January.

“With night-time driving already riskier, combined with cold weather, the propensity for large claims – and therefore larger losses – increases in this period,” commented Alex Brockman, Director of Operations at ThingCo. “The good news is that insurers who deploy preventative measures can help reduce accident frequency over the Christmas period. Even simple strategies such as sharing tips and advice with customers can help, although strategic partnerships and tech solutions will go further still.”

Real-time risk management processes embedded into the ThingCo solution stack enables increased vigilance and is particularly effective at monitoring excess speeders where the propensity for large claims is at its highest in the winter months. In addition, tailored communication can be targeted to customers who are known historically to drive late at night can mitigate against the increased percentage of trips driven between midnight and 5am.

Peak seasons such as Christmas place greater demands on claims departments, especially as teams balance the increased workload with managing staff holiday commitments. There is also the additional challenge that when repairs are required over the holiday period, they inevitably take longer to arrange and complete as garages are closed or staffing levels are lower. Utilising telematics within accident prevention processes can ease the burden by reducing claims volume as well as helping to manage claims more effectively.

Alex Brockman added: “As well as helping drivers be more cautious on the road to reduce risk, we advise our partners to be extra vigilant to casual business use over the Christmas period, such as delivery drivers using their private vehicles. Our anti-business-use monitoring tool for Social, Domestic and Pleasure customers plays a critical role in reducing risk in this area. As risk and claims frequency falls, so do costs, meaning insurers can price more competitively whilst also helping to keep drivers safer.”